How can I obtain gross receipts tax coupons?Ī.

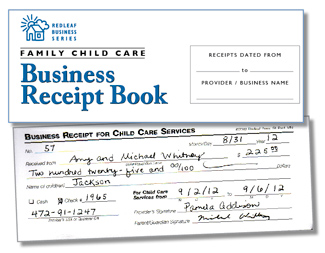

BUSINESS RECEIPTS LICENSE NUMBER

You may now file your gross receipts tax returns online and make a payment via credit/debit card or by Automated Clearing House (ACH) transaction from your checking account by visiting and clicking the link “File Gross Receipts Tax.” You will need either your Federal Employer Identification Number or Social Security Number and your Business License Number to access the system. Am I required to file gross receipts tax coupons electronically?Ī. In addition to the above penalties and interest, an additional penalty of 1% per month (not to exceed 25%) is imposed for failure to pay (in whole or in part) the tax liability shown to be due on a timely filed return.

BUSINESS RECEIPTS PLUS

Gross receipts tax returns filed late are subject to a penalty of 5% per month, plus interest of 0.5% per month from the original due date until paid. What penalties apply to late filing and/or payment of gross receipts tax?Ī. Please note that all new businesses are automatically set-up as quarterly gross receipts tax filers. If you are set-up as a quarterly filer, then your gross receipts tax is due on or before the last day of the first month following the close of the quarter. If you are set-up as a monthly filer, then your gross receipts tax is due on or before the 20th day of each month with respect to the aggregate gross receipts for the immediately preceding month. The Division of Revenue uses a “look-back period” to determine whether a business is a monthly or quarterly filer. Delaware Gross Receipts tax returns and payments are due either monthly or quarterly, depending on a business’ total gross receipts. When are the gross receipts tax returns due?Ī. Please note that failure by the seller to maintain a list of exemption certificates and to note on each sales invoice that an exemption is being claimed will cause the sale to be taxable. Form 373 is used to substantiate exempt sales to out of state purchasers which are picked up in Delaware. But only if you complete Form 373 Wholesale Exemption Certificate prior to or concurrent with the sale. As a Delaware ‘Wholesale’ business, if my customer takes possession of the merchandise in Delaware for subsequent delivery and consumption outside this state, am I liable for gross receipts tax on that sale?Ī. Delaware gross receipts tax is due in instances when the retail customer picks up or takes delivery of the product in Delaware, regardless of the ultimate destination. As a Delaware ‘Retail’ business, if my customer takes possession of the merchandise in Delaware but takes it out of state, am I liable for gross receipts tax on that sale?Ī. You do not have to pay gross receipts tax on goods shipped by you directly to your customer outside of Delaware, but you need to keep documentation of the interstate shipment. As a Delaware ‘Retail’ or ‘Wholesale’ business, am I liable for Delaware gross receipts tax on merchandise shipped out of state?Ī. To determine the exclusion for a specific business activity in the State of Delaware, please visit the Tax Tip for your business type. These exclusions, provided monthly or quarterly, generally start at $100,000 per month and can be as high as $1,250,000. When determining the gross receipts tax due, most businesses are entitled to an exclusion, which varies depending on the business activity conducted. Are there any Gross Receipts Tax Exclusions available?Ī. There are no deductions for the cost of goods or property sold, material or labor costs, interest expense, discounts paid, delivery costs, state or federal taxes, or any other expenses allowed. This tax is paid by the seller of goods (tangible or otherwise) or the provider of services in the state. When you engage in business in the State of Delaware, you may be required to pay Gross Receipts Tax. Who is required to pay Delaware’s Gross Receipts Tax?Ī. To determine the gross receipts tax rate for a specific business activity in the State of Delaware, please visit the Tax Tip for your business type. 7468%, depending on the business activity. Gross receipts tax rates currently range from. This tax is levied on the seller of goods or services, rather than on the consumer. Delaware’s Gross Receipts Tax is a tax on the total gross revenues of a business, regardless of their source.

What is the Delaware Gross Receipts Tax?Ī.

0 kommentar(er)

0 kommentar(er)